s corp tax calculator nyc

You can also use our New York property tax calculator to find out what you would pay in property taxes in New York. 100s of Top Rated Local Professionals Waiting to Help You Today.

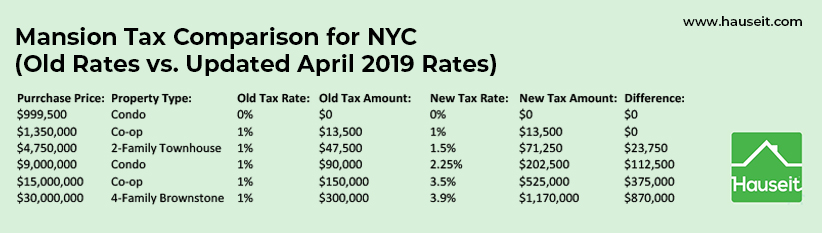

Nyc Mansion Tax Of 1 To 3 9 2022 Overview And Faq Hauseit

We are not the biggest firm but we will work with you hand-in-hand.

. Apart from that other features of an S corporation such as formation ownership contracting and other business activities are similar to. Ad We Simplify The Process And Keep It Industry-Specific So You Can File Taxes w Confidence. As a sole proprietor you would pay self-employment tax on the full 90000 90000 x 153 13770.

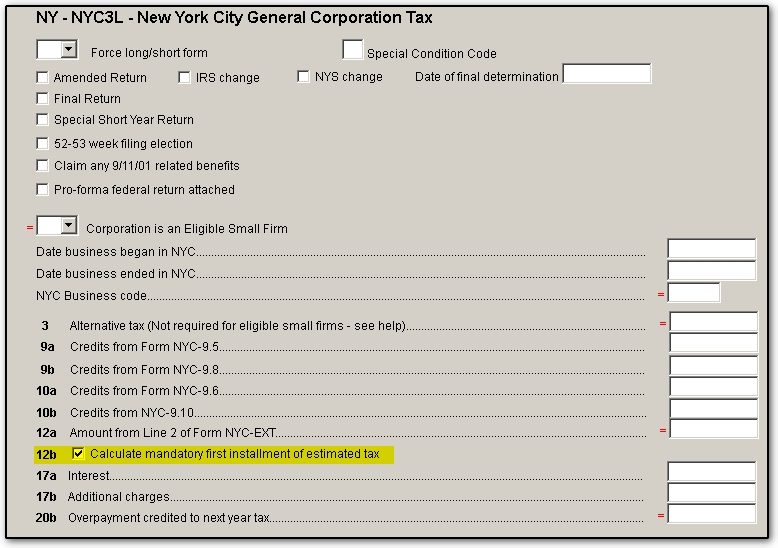

10 -New York Corporate Income Tax Brackets. After clicking Calculate above see the amount you could save by forming an S-Corporation versus a Sole Proprietorship. The instructions to Forms NYC-3L and NYC-4S explain in detail which types of S corporations are exempt from the general corporation tax including.

But as an S corporation you would only owe self-employment tax on the 60000 in salary 60000 x 153 9180 resulting in a savings of 4590. Enter your estimated annual business net income and the reasonable salary you will pay yourself as an S Corporation employee to begin. S corporations are similar to regular corporations except for their special tax treatment with the federal or New York state tax authorities.

S-corporations are exempt from the Business Corporate Tax but they are still subject to the General Corporation Tax or Banking Corporation Tax. For example if you have a business that earns 200 in revenue and has 75 in expenses then your taxable income is 125. Regardless if youre self-employed or an employee you have to pay Social Security and Medicare taxes to the government.

Ad Find Recommended New York Tax Accountants Fast Free on Bark. Here is an outline of the steps you need to follow in order to form a corporation in New York. Start Using MyCorporations S Corporation Tax Savings Calculator.

Nonresident shareholders and part-year resident shareholders pay tax only on the S corporation items derived from New York sources which is determined at the corporate level. Lets start significantly lowering your tax bill now. New York City is an economic hub and part of the engine that makes the global economy work.

The exemption for the 2021 tax year is 593 million which means that any bequeathed estate. New York State uses a formula based on the highest of three tax bases to calculate how much corporate franchise tax an entity owes. You should also read the general section on forming a.

PAyroll taxes paid as an s-corporation With a salary of and a dividend of. Forming operating and maintaining an S-Corp can provide significant tax benefits. New Yorks estate tax is based on a graduated rate scale with tax rates increasing from 5 to 16 as the value of the estate grows.

AS a sole proprietor Self Employment Taxes paid as a Sole Proprietor. Now if 50 of those 75 in expenses was related to meals and. See the New York State website for more information on the formulas used as well as the minimum tax rates.

Tax Bracket gross taxable income Tax Rate 0. Use our detailed calculator to determine how much you could save. LLC Calculator guide will explain how to tell whether an S corp.

New York has a flat corporate income tax rate of 7100 of gross income. For example in New York City an S-corp would be subject to the citys 885 business tax on top of state and federal taxes. Dormant S corporations which did not engage in any business activity or hold title to real property located in New York City.

Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of those expenses. Our S Corp vs. This calculator helps you estimate your potential savings.

IT-2658-MTA Fill-in 2022 IT-2658-I Instructions Attachment to Form IT-2658 Report of Estimated Metropolitan Commuter Transportation Mobility Tax MCTMT for New York Nonresident. With multiple colleges and universities throughout New York many college students graduate and stay in New York City to start small businesses. This application calculates the federal income tax of the founders and company the California state franchise tax and fees the self-employment tax for LLCs and S-Corps pass-through deductions for passthru entities and the.

From the authors of Limited Liability Companies for Dummies. When you work for someone else youre only responsible for part of these taxes while your employer pays the balance you pay about 765 and your employer. Shareholders pay New York tax on their pro rata share of the S corporation pass-through items of income gain loss and deduction that are includable in their federal adjusted gross income.

S corp status also allows business owners to be treated as employees of the business for tax purposes which can result in tax savings. An S corporation S corp is a tax status under Subchapter S of the IRS tax code that you can elect for your limited liability company or corporation. This could potentially increase the S-corp tax bill significantly and essentially wipe out the other tax advantages offered by this entity structure.

The NYC S Corp Tax provides a wide array of tax benefits for prospective owners of small businesses. Our Easy Step-By-Step Process Takes The Guesswork Out Of Filing Self-Employed Taxes. These tax bases are 1 business income 2 capital and 3 a fixed dollar minimum tax.

The federal corporate income tax by contrast has a marginal bracketed corporate income taxThere are a total of twenty three states with higher marginal corporate income tax rates then New York. Calculate taxes for LLCs corporations electing Subchapter S tax treatment S-Corps and corporations not making Subchapter S elections C-Corps. New York Estate Tax.

S corporations subject to tax under the banking corporation tax. Also take a look at our blog and video at What you Really Need to Know About S-Corp Tax Savings. Forming an S-corporation can help save taxes.

Form IT-2658 is used by partnerships and S corporations to report and pay estimated tax on behalf of partners or shareholders who are nonresident individuals. Subject to the tax. S-Corp Tax Savings Calculator.

Reduce your federal self-employment tax by electing to be treated as an S-Corporation. Publicly traded partnerships that were subject to the City Unincorporated Business Tax in 1995 and made a one-time election not to be treated as a corporation and instead to continue to be subject to the Unincorporated Business. Use this calculator to get started and uncover the tax savings youll receive as an S Corporation.

The Nyc And Nys Transfer Tax Rptt For Sellers By Hauseit Medium

New York City Taxes A Quick Primer For Businesses

New York City Taxes A Quick Primer For Businesses

Interview With Graphic Designer Rafael Esquer Of Alfalfa Studio I Love Ny Graphic Design Logo

Nyc Mansion Tax Of 1 To 3 9 2022 Overview And Faq Hauseit

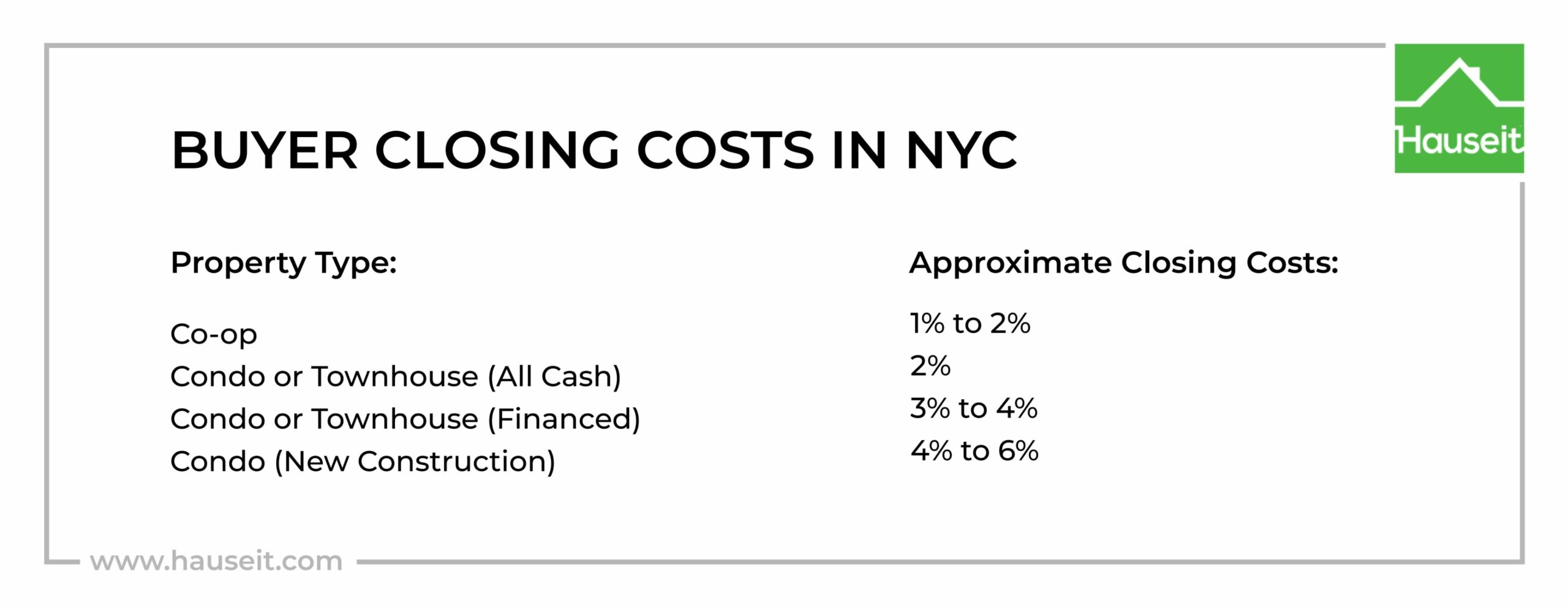

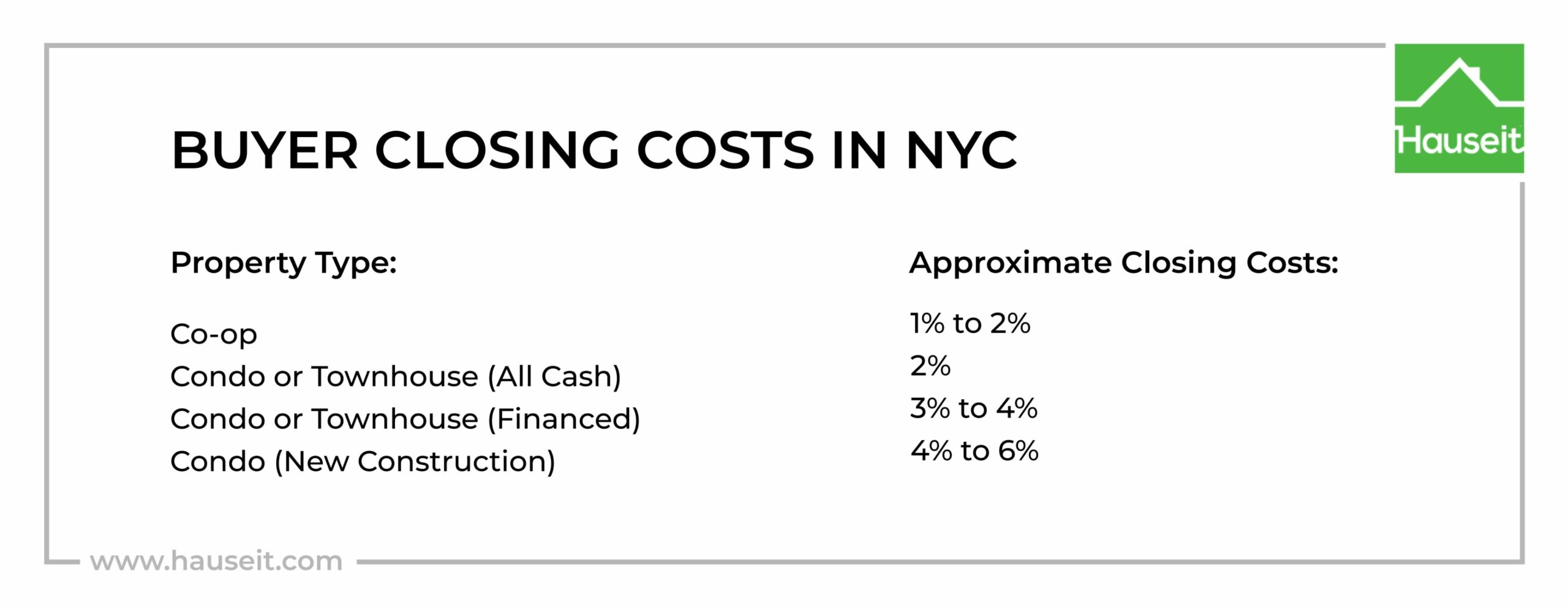

Nyc Buyer Closing Cost Calculator Interactive Hauseit

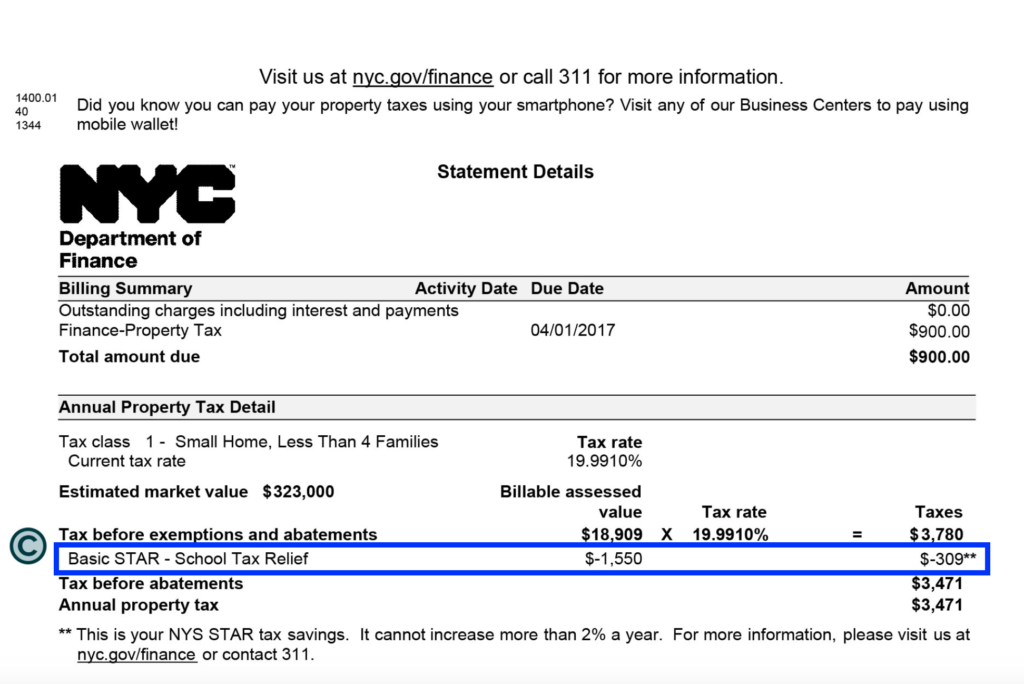

What Is The Basic Star Property Tax Credit In Nyc Hauseit

Ny State And City Payment Frequently Asked Questions

What Is The Average Co Op Flip Tax In Nyc And Who Pays It By Hauseit Medium

The Complete Guide To Closing Costs In Nyc Hauseit

Ny State And City Payment Frequently Asked Questions

Nyc Mansion Tax Of 1 To 3 9 2022 Overview And Faq Hauseit

Pin By Experto Tax Service On Experto Tax Service Tax Services Disasters Convenience Store Products

Business Taxes Nyc David Beck Cpa Accurate And Timely Returns

Mansion Tax Nyc Everything You Need To Know Yoreevo Yoreevo

The Donotpay App Is The Home Of The World S First Robot Lawyer Fight Corporations Beat Bureaucracy And Sue Anyone At The Press Of A First World Fight Lawyer